# Venture Capital

## VC Firm

- Venture Capital Firm

- Varies between countries

- Invest in a _venture capital fund_

- About 1k VC firms in the US.

- Very difficult for those without a proven track record as entrepreneur or

investor to form a VC form.

- Two-thirds of the VC firms only launched one fund.

- Venture capital prefers CSE, prefers software even more.

- VC prefers 2B businesses.

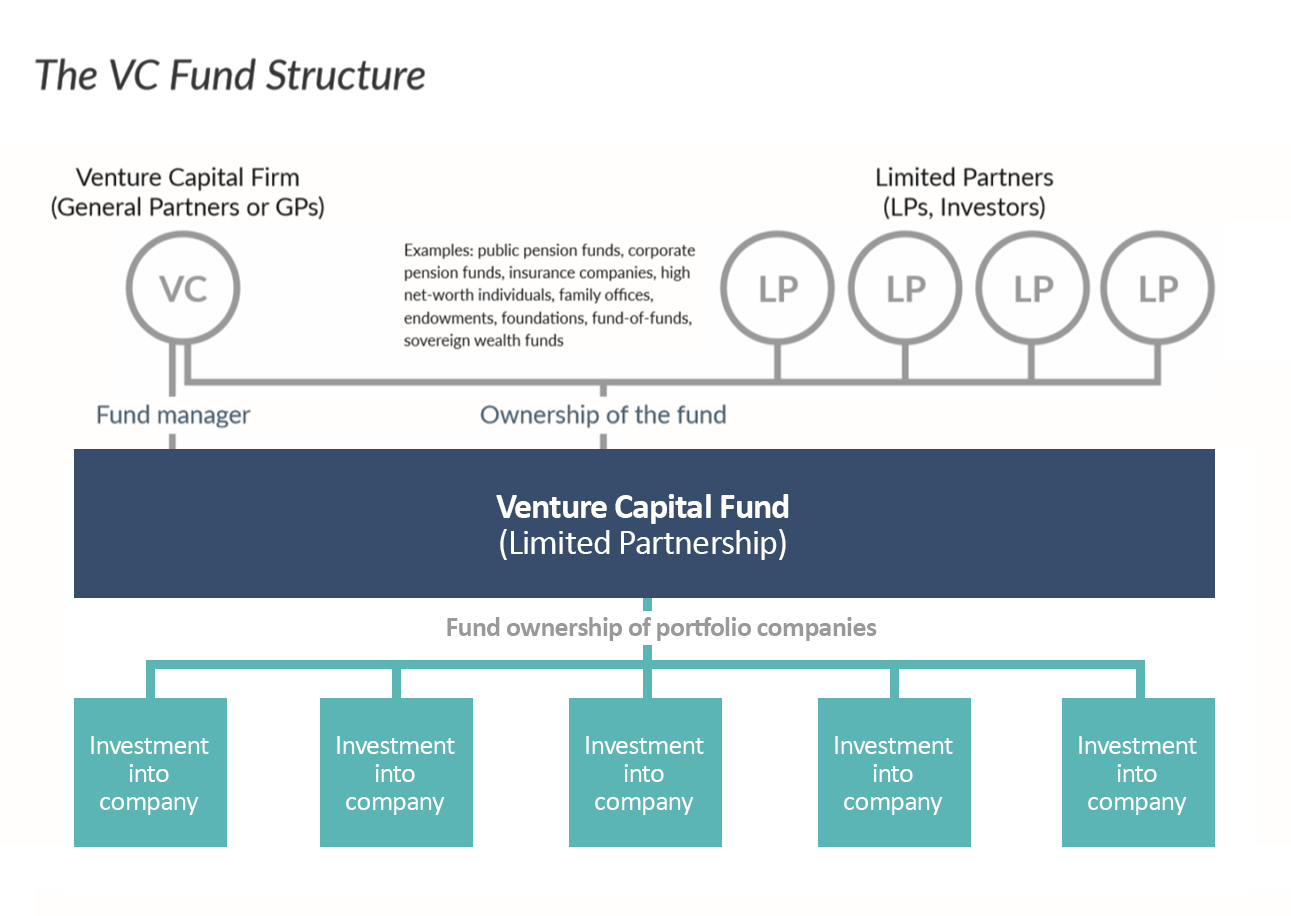

- _General Partners_

- Decides the industry to invest in

- Normally 5 to 8 GPs, could be 1

- Arguments: should carried interest be subject to ordinary income or long

term capital gain?

- VC Firm and GPs seek to raise a fund.

- May also put money in.

- Receives _annual fee_, typically 2% of the value of the fund.

- Also receives _carry_, a percentage of net profit (typically 20%)

- Originates from sailing: you pay 20% commission for whatever carried in the

ship.

- Spend half of their time recruiting management and serving as

directors/monitors.

- _Limited Partners_

- Put money into the pool of fund.

- Must wait for 10 to 12 years to see the return.

## The Profit

- Aims for 25% to 35% of profit yearly over the life time of the VC fund.

- A small number of VC funds generates the biggest return (multiple times)

- Vast majority of return is generated by a few successful companies

- Even the best VC firms, they lose money in 40% of the investments.

- Every investment must have the potential to be the home run!

> [!tip] Picking the Winners

>

> - Ideas are more malleable than people.

> - Large addressable market size.

> - Look for startups that grow exponentially without diminishing the marginal

> costs.

> - Look for _unfair_ product, [[business-model|business model]], and culture.

> [!tip] 5 Essential Elements that Lead to Success

>

> - Ideas

> - Team

> - Business Model

> - Funding

> - Timing (most importatn)

## The Process

- VC Firm & GP seek to raise a fund

- GP selects startups

- GP manages fund and more investments over fund life

- GP manages [[ipo|IPO]] or purchase "exits"

- Money were distributed among GP, LP, and other investors.

[Limited Partnership: What It Is, Pros and Cons, How to Form One](https://www.investopedia.com/terms/l/limitedpartnership.asp)

## From Founder and Early Team Point of View

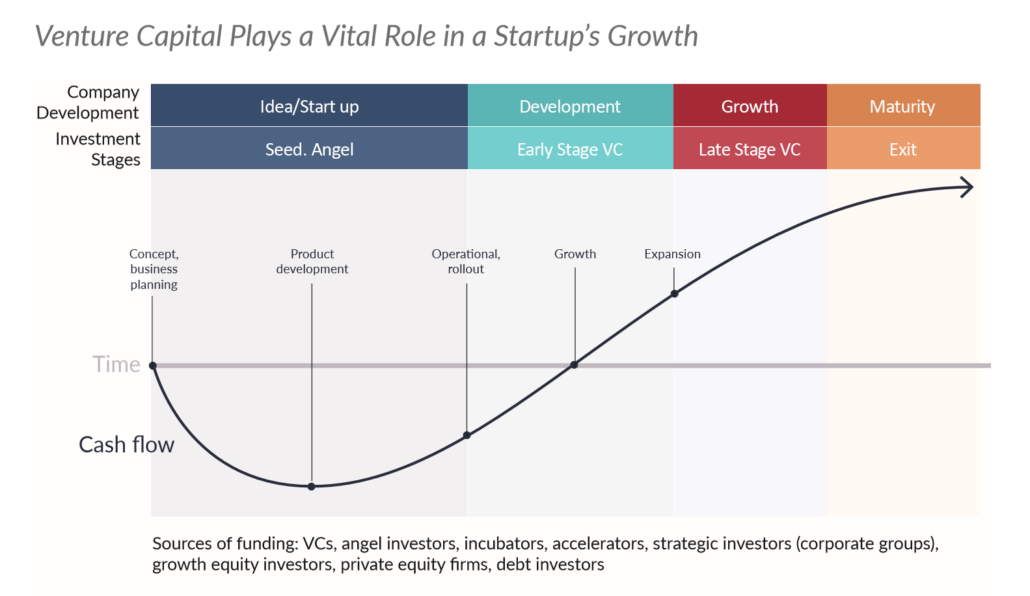

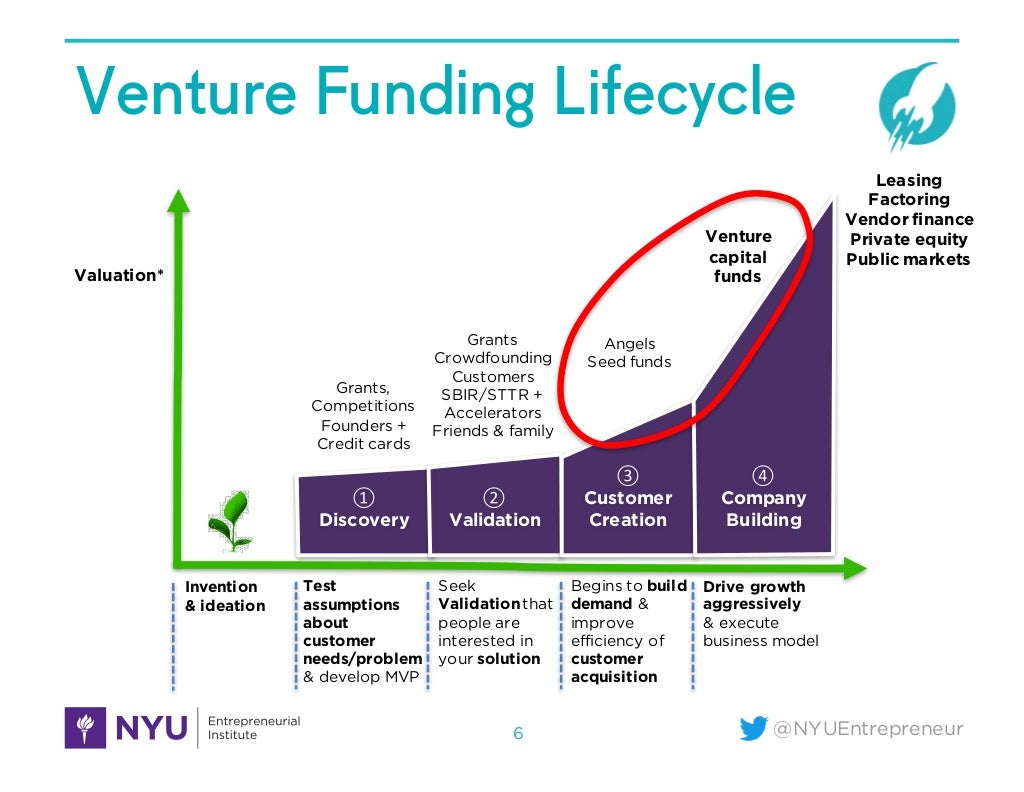

- Venture Funding Lifecycle

- Discovery - Grants, Competition, Credit Cards

- Validation - Crowd Sourcing, SBT, SBI

- Customer Creation - Angels, Seed Funds

- Company Building - Venture Capital

- Founder equity splits

- [Founders' Agreement Template](https://www.pandadoc.com/founders-agreement-template/)

- one-year cliff, four-year vesting

- Founder's Agreement

- [[cap-table|Capitalization Table]]

- [[mvp|Minimum Viable Product (= MVP)]]

- [[stock-option|Stock Options]]

- Incentive

- Non-statutory

## Resources

- [5 charts: Startups feel the squeeze in Q3 | PitchBook | 2023](https://pitchbook.com/news/articles/venture-monitor-charts-startup-exits?)

- "The ratio of capital demand to supply has skyrocketed to its highest level

in over a decade for later-stage startups."

- IPO freeze, investors leaving the VC field, leading to a investors' market

for VC funding.

## Positions

- [[vc-analyst|VC Analyst]]